How Doxim CRM enables Canadian credit unions to converse more intelligently with members.

The current economic environment, with the threat of transformative and transitionary tariffs, presents challenges and opportunities for Canadian credit unions. For credit unions, uncertain times of crisis always serve as an opportunity to serve members and communities better.

To help Canadian credit unions better serve their members with a data-driven perspective, we’ve highlighted one of Doxim’s recent feature updates: a PMG Intelligence widget on the Doxim CRM member dashboard. This integration makes PMG’s industry-leading predictive analytics, machine learning and research-based insights available in every member search, enabling more informed and timely member interactions.

This analysis outlines Doxim’s roadmap for data-driven member engagement: from evolving financial services member journeys to Doxim CRM’s retail and small business core platform capabilities, culminating in the impact of predictive analytics through PMG’s widget.

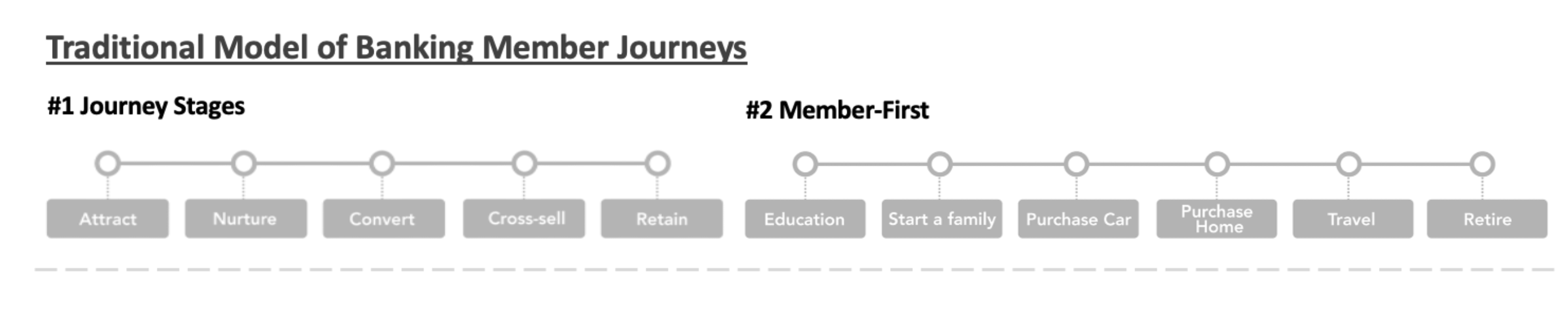

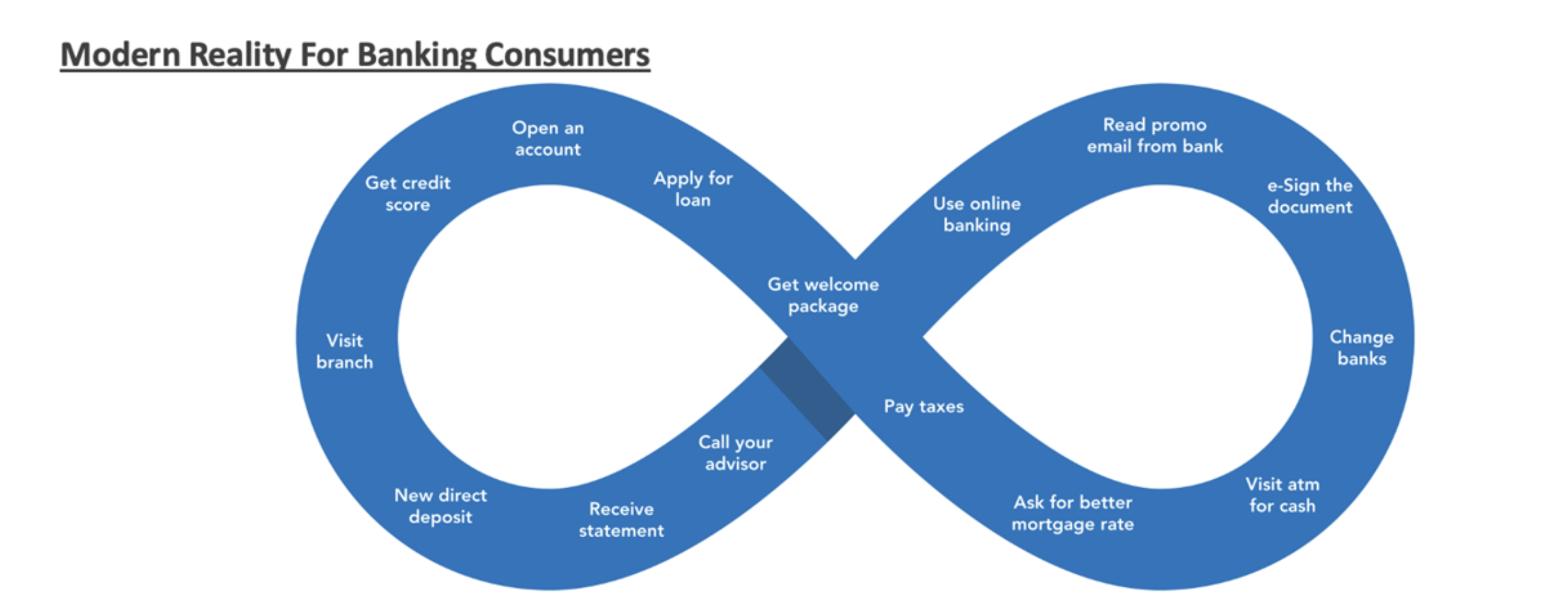

The Shifting Reality of Member Journeys

A Modern Member Story: How Intelligence Drives Engagement

Meet Hope. She is recently married, solves everything through her phone, enjoys tracking her earnings in real-time, and plans activities for after 3 pm. She’s part of a longstanding member family but has distinct preferences: digital-first, no cold calls, with evening availability.

Every opportunity that her financial institution interacts with her, whether in person or through the phone, is an opportunity to have an impact, depending on her segment and life stage. Enabling staff members at credit unions and the credit union itself to have deep intelligence into Hope’s life stage expands the ROI of the interaction by 10-fold.

Doxim CRM + PMG Intelligence: Enhanced Member Intelligence at Point of Search

The PMG Intelligence widget that appears in the Doxim CRM dashboard during member searches, provides staff with immediate access to engagement scores, key advice factors, and next best actions. This integration leverages PMG’s extensive research into Canadian financial behavior to deliver relevant insights precisely when staff need them, along with segmentation and actionable next-best actions.

Retail Members and Prospective Members

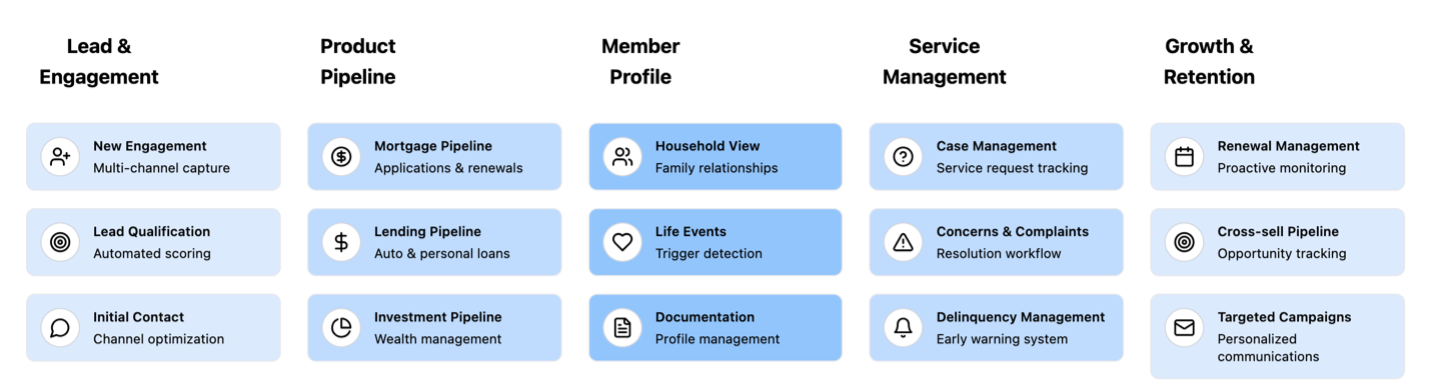

Doxim CRM Workflows for Retail Teams

The evolution of Doxim CRM+ in recent years stems from a fundamental observation: credit union staff spend too much time piecing together member information and not enough time building meaningful relationships. Our solution addresses this by unifying household relationships, product portfolios, and interaction histories into a thoughtfully designed interface that puts relevant information at staff’s fingertips.

Retail staff access complete household relationships, product portfolios, and service histories in a single view, while automated processes manage everything from new member onboarding to investment reviews and mortgage renewals.

The platform coordinates all engagements, pipeline, member concerns, welcome communications, scheduled consultations, seasonal outreach, and tracks service resolution, ensuring consistent, high-quality member engagement across all channels.

The PMG Intelligence widget integration represents our commitment to making every member interaction more meaningful. By surfacing relevant insights at the right moment, we help staff transition from reactive service to proactive guidance that aligns with members’ evolving needs.

Doxim CRM

- Member Profile

- Household View

- Product Portfolio

- Service History

PMG Intelligence

- Segmentation

- Predictive Analytics

- Next Best Action

Doxim CRM Actions

- Create Opportunities

- Schedule Follow-Up

- Document Interactions

- Track Outcomes

Small Business and Commercial Members

Doxim CRM Commercial Banking Workflows

Commercial banking is fundamentally different from retail, and this is why many teams at credit unions use different systems of record to manage commercial members. Through extensive research with commercial teams at credit unions, Doxim CRM+ enables a unified system to address the unique complexities of business relationships as well as unique households with business owners. Our platform helps staff navigate intricate business hierarchies while managing essential processes like loan pipelines and compliance documentation—all without losing sight of the relationship aspect.

We recognize that commercial relationships thrive on trust and understanding. That’s why credit unions can utilize Doxim’s workflows to streamline necessary tasks like credit reviews and site visits, while preserving staff’s ability to exercise judgment and maintain personal connections.

In addition, staff can track commercial documentation, manage credit reviews, and coordinate site visits while maintaining clear visibility of growth opportunities across their portfolio through Doxim CRM+.

Doxim CRM Research

- Member Profile

- Household View

- Product Portfolio

- Business Relationships

PMG Intelligence

- Segmentation

- Predictive Analytics

- Next Best Action

Doxim CRM Actions

- Track Business Growth

- Manage Solutions

- Record Engagement

- Monitor Progress

Operational Benefits

The integration streamlines member service by incorporating PMG directly into existing member dashboards. During member searches, staff receive:

- Current segment scores with trend indicators

- Research-backed advice factors

- Segment-specific next-best actions

- Proven conversation topics for segments

Looking Toward the Transformation Ahead

As economic conditions evolve, delivering timely, relevant member support becomes increasingly critical. Integrating PMG Intelligence in the Doxim CRM+Dashboard gives Canadian credit unions the tools to identify and act on member needs more effectively.