Are Financial Institutions Ready For The New Era Of Digital CX?

COVID-19 has changed the way people interact with their bank or credit union, making it critical to consider how financial institutions can improve customer experience based on new expectations.

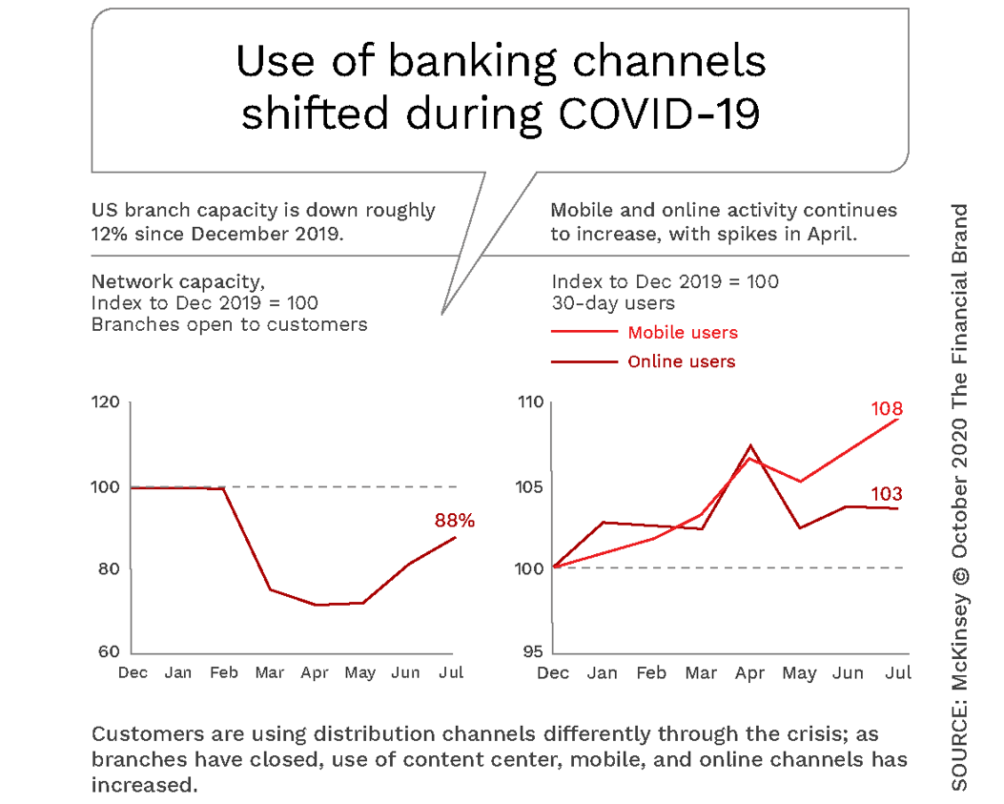

Meanwhile, mobile and online banking activity increased, growing both the number of customers transacting on these channels and the frequency of usage.

This trend is expected to continue into the future, as more customers, as well as financial institutions, become familiar with and experience the benefits of interacting via digital channels.

However, an increase in digital channel adoption/usage is simply not enough to guarantee a great customer experience, nor customer retention.

Consumers expect seamless, personalized interactions across all communication channels. Engaging customers effectively in a new contactless world is key to building trust, loyalty and ultimately, a good customer experience.

How financial institutions can improve customer experience in today’s contactless landscape

Even before COVID-19, customers wanted omnichannel, consistent, relevant, and personalized experiences. These needs have been heightened by the impact of restrictions on face-to-face interactions and branch services.

There is also a marked change in the values that customers expect to see from their service providers, with an emphasis on kindness, community, and purpose. Customers want to feel a connection, outside of the service they receive.

For financial institutions, it’s vital that they align with the new expectations and needs of their customers, as customers entrust these organizations with their most sensitive information and personal assets.

Let’s take a look at how financial institutions can improve customer experience.

Leverage digital communication

Relevant and personalized information is vital to build engagement, trust and deliver a great CX in financial services. Digital communication provides the opportunity for the bank or credit union to engage via the terms and channels the customer prefers.

Ensure frictionless customer experiences

In addition to offering exceptional value, banks and credit unions should focus on each customer or member journey and remove any interaction that causes friction. When people are anxious and uncertain, the last thing they need is to be frustrated by a complex communication and issue resolution process.

Help customers make financial decisions by ensuring that processes are simple and intuitive.

Improve consistency in your customer messaging

Customer journeys can also become fractured by inconsistent communication. It’s therefore imperative that financial institutions align all customer communication to create a positive and consistent CX.

Too often, what the customer experiences when they interact with a brand is fractured because of how the organization is structured, specifically which departments are customer facing and who is responsible for managing communication within each customer journey.

Aim to build a holistic view of all communication going to customers, and then to align the brand voice, design and tone. This is vital to achieving a seamless CX across customer journeys, communication types and digital channels.

Put employees and customers at the center of digital transformation

Research shows that customer experience leaders have highly engaged employees, who are more likely to recommend the company’s products and services and display a higher level of accountability. It follows that organizations need to take care of their employees as a priority – the happier the employee, the better the customer experience.

Let us help you improve CX through insight-driven, personalized communications that create engaging experiences across customer touch-points. TALK TO US