In an environment of increasing interest rates and financial uncertainty, members increasingly rely on their credit unions to have a deep understanding of their financial needs, and to provide holistic, timely, personalized service and advice based on this understanding.

Unfortunately, when many financial processes are still managed manually, it is difficult to deliver the insights, speed, and quality that members demand.

Without the benefit of a comprehensive customer engagement management (CEM) solution, the time required to complete essential activities like account and loan origination, member data gathering, and tracking campaign effectiveness is substantial.

Conversely, with a modern CEM solution in place, credit unions experience a variety of efficiencies which in turn lead to increases in revenue and member engagement. To truly understand these benefits, Doxim worked with Hobson & Company, a research firm focused on Return on Investment (ROI) studies, to uncover the benefits our clients experienced from Doxim CEM. Here’s a bit of what they found.

Reducing the time spent setting up new clients, accounts, and loans

Many credit unions are still hampered by inefficient account and loan origination processes. Despite recent advances in digital banking, which resulted from the COVID-19 pandemic, the time spent managing account or loan applications with paper-based or less sophisticated processes can also be extensive.

Organizations without a comprehensive CEM platform need to collect all of the member information to fill in the loan or account applications and then evaluate each application. These processes are also prone to inconsistencies and errors and may require MSRs to enter and re-enter data across multiple legacy systems. Clients interviewed noted that it could take days to complete the onboarding of a single new member, and as much as a day or more to set up and review a new loan application.

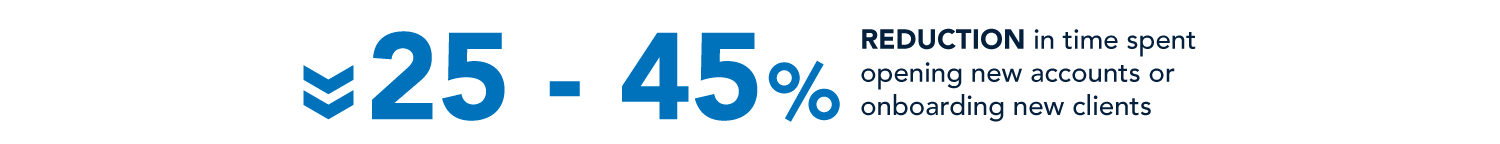

With a CEM solution in place to reduce data entry and re-entry and prevent errors, Doxim clients note significant efficiencies, including:

“A 65-85% reduction in the number of hours needed to onboard a new client.”

-VP, Business Initiatives

Clients interviewed reported the potential for

Move seamlessly between retail and business workflows or between in-branch and self-service channels without gaps.

Decreasing costs associated with sales and marketing efforts

Credit unions store a goldmine of data on member needs, behaviors, and trends. But too often, this data is spread across multiple legacy systems and isn’t available for timely analysis and action. With a CEM solution that includes a Customer Relationship Management (CRM) tool, credit unions have access to a single, central, source of truth about the member. They can run analyses against this data, and match products and services to segments, to make more targeted sales pitches and highly personalized marketing communications. They can then track the results of these campaigns, and fine-tune their marketing efforts, reducing the costs of sales and marketing efforts and increasing revenue. As one Doxim client noted, they:

Can now see which promotions and customer outreach programs worked and which didn’t, helping to inform future promotional spending decisions.

-Research manager

With Doxim CRM, gain access to complete information about your members for improved service and profitability.

Increasing member engagement and satisfaction

In an increasingly customer-centric time, credit unions can’t afford to let legacy technology and processes erode the member experience. Without a CEM solution in place, members often feel like numbers, as they have to tell and re-tell their stories to multiple staff members to have issues resolved.

With a modern CEM solution in place, member service representatives have access to a full member snapshot at a glance, including financial data, current product holdings, and all engagements across all touchpoints, so service or sales conversations can be picked up right where they left off. By making these interactions more efficient and personal, credit unions can increase member satisfaction and retention. Employees are also less frustrated and more productive when the information they need to support members is right at their fingertips. Instead of digging for answers, they can use their time to make meaningful connections with members, and even document additional member needs and upsell useful products and services.

The improved visibility into customer activity and discussions, captured in Doxim, has helped customer service and retention.

-Specialist, Banking Solutions

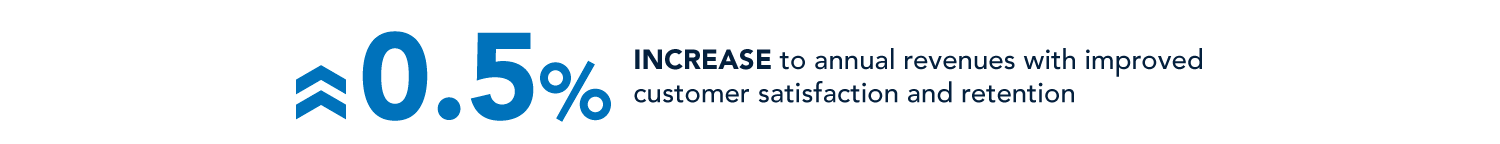

Clients interviewed reported the potential for:

Doxim’s CEM platform delivers strong cost savings and a quick return on investment

Implementing a comprehensive customer engagement management solution from Doxim can achieve a return of 113% over 5 years and a positive cash flow within 7.3 months. Benefits include:

- Estimated annual benefits $129,000 from increased efficiencies alone.

- Estimated annual savings of $239,000 when including reduced costs and improved CX.

- An ROI of 113% over 5 years

If your account opening and loan application process is manual or cumbersome, you can achieve a fast ROI and many other benefits from a customer engagement management platform from Doxim.

Investment in Doxim’s CEM platform can generate positive cash flows in 7.3 months. Let’s help your credit union achieve these results.