How To Gain Greater Market Share In The Large Broker Led Mortgage Landscape

Having worked with credit unions and similar financial institutions (FIs) for a number of years, we understand that they are focused on improving customer experiences by providing high touch points and enhanced services. The challenge is in developing a roadmap to enable the ecosystem innovation and technology journeys necessary to grow and provide new experiences to customers in conjunction with keeping the personal touch that community financial institutions provide.

A demonstration of the value of personal relationship-based interactions for banking customers is in the mortgage buying cycle. The mortgage buying journey increasingly skews away from FIs and towards the experience of working with a broker, who provides a high-touch, advisory experience for sellers and buyers through an ecosystem of lenders, appraisers, sellers, and other parties.

In this area, the existing origination and technology landscape opens the possibility of new innovations and new value chains in the customer, broker and lender relationships through digital experiences.

Having worked with credit unions and similar financial institutions (FIs) for a number of years, we understand that they are focused on improving customer experiences by providing high touch points and enhanced services. The challenge is in developing a roadmap to enable the ecosystem innovation and technology journeys necessary to grow and provide new experiences to customers in conjunction with keeping the personal touch that community financial institutions provide.

A demonstration of the value of personal relationship-based interactions for banking customers is in the mortgage buying cycle. The mortgage buying journey increasingly skews away from FIs and towards the experience of working with a broker, who provides a high-touch, advisory experience for sellers and buyers through an ecosystem of lenders, appraisers, sellers, and other parties.

In this area, the existing origination and technology landscape opens the possibility of new innovations and new value chains in the customer, broker and lender relationships through digital experiences.

Discover how Doxim can help your financial institution expand its mortgage portfolios with third-party integrations…

Book a DemoHow well does your bank or credit union develop relationships with new high performing brokers?

Today in Canada, there are over 20 000 mortgage brokers eager to help customers secure the right mortgage, according to a recent Filogix report. These brokers control 40-50% of the mortgage market, and their share of the market continues to grow. To increase mortgage originations at a bank or credit union, FIs should be looking for ways to harness the power of this workforce. Most banks and credit unions have relationships with a few mortgage brokers that they work with repeatedly. But to truly boost mortgage origination rates, they need to cast a wider net and become a preferred lender for a broader network of brokers. Developing new relationships with new high performing brokers can be supported by having a tech infrastructure to allow the submission of and communication around opportunities and having it be seamless..How to gain greater market share in the large broker led mortgage landscape

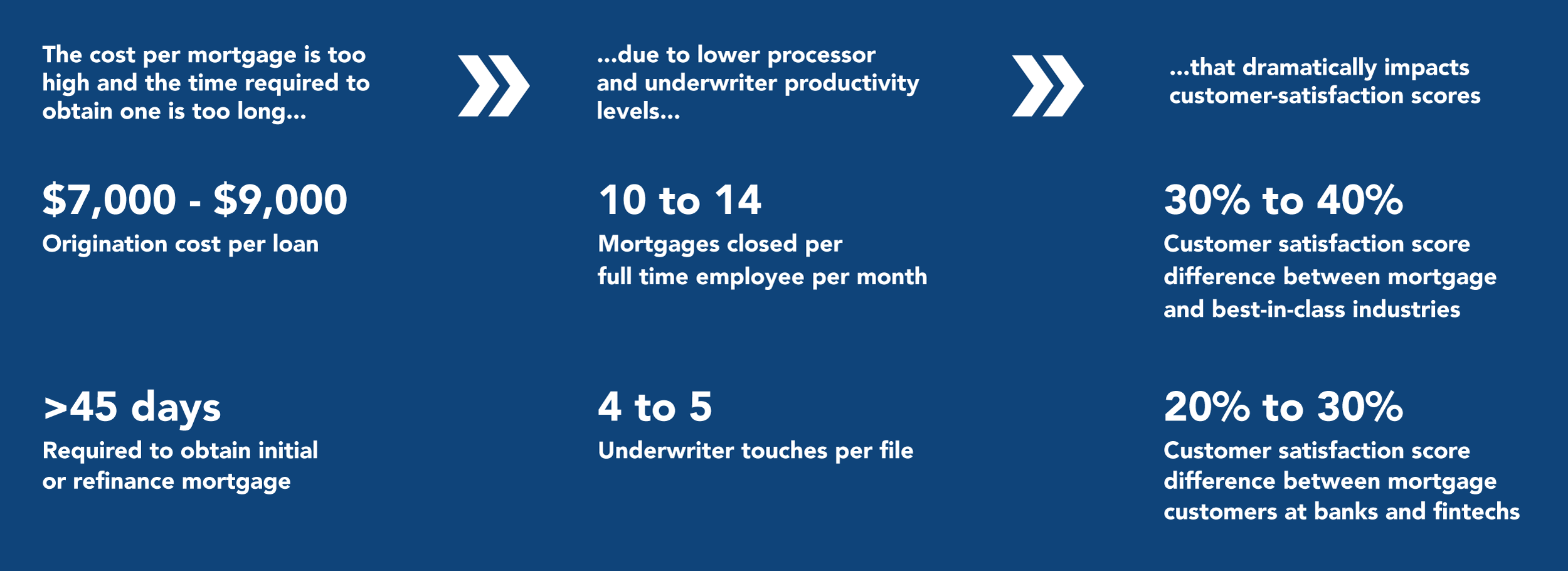

Currently, big banks in Canada have very close relationships with high performing brokers, controlling over 80%1 of the broker-led lending market. One of the reasons for this stranglehold is that big banks go out of their way to be easy and quick for brokers to work with. Conversely, mortgage origination at many community banks and credit unions is still a slow and manual process, taking over 45 days to complete and costing 7000-9000 dollars per file. This situation not only reduces customer satisfaction, it also makes these organizations less appealing partners for busy brokers. Big banks and fintechs are already making strides towards faster and more accurate digital mortgage origination, allowing brokers to close more deals per month with less back and forth. Broker networks will naturally prefer to work with organizations that make their interactions faster and more effortless.Many mortgage operating models still grapple with elevated costs and long cycle times.

Image source: McKinsey & Company

Image source: McKinsey & Company

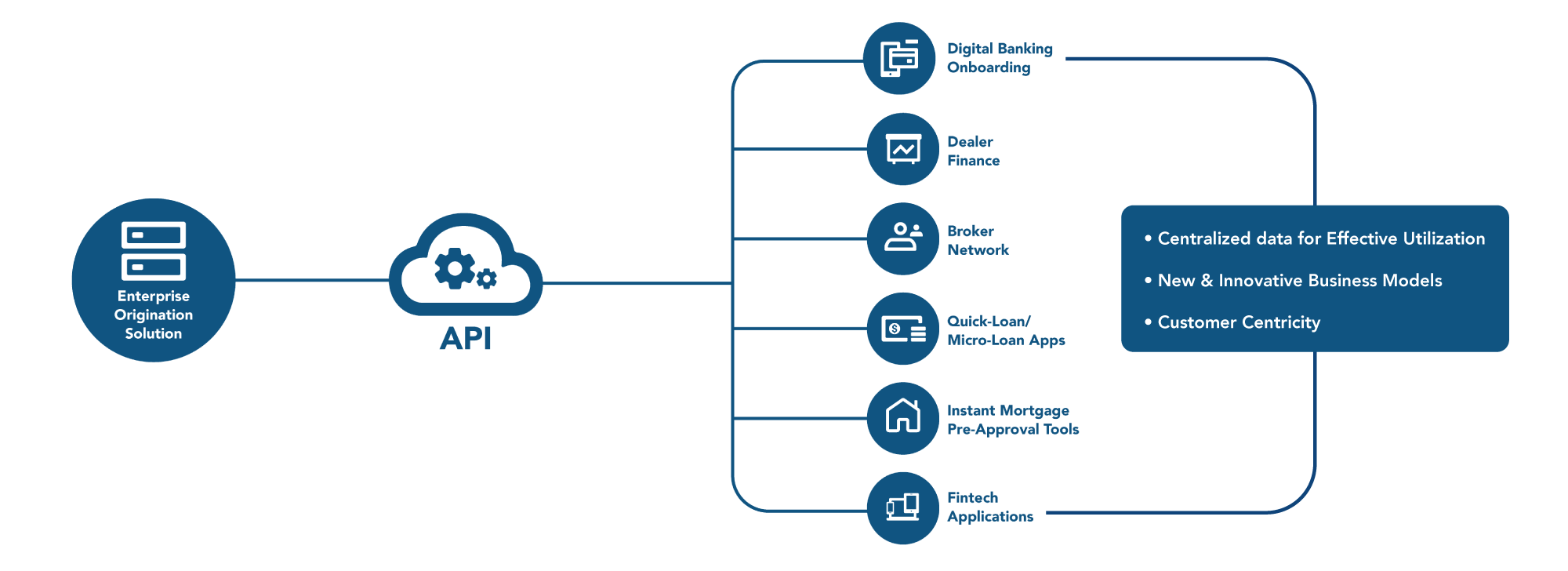

Ecosystem innovation: the financial institution as aggregator to ingest mortgages, auto loans, merchant relationships, BNPL users, digital currency customers

End customers, including those working with broker dealers, often have lending needs outside their mortgage to consider. Recent research from the National Association of Realtors indicates that about 95% of home buyers would consider a one-stop-shop model for their home-buying journey, and 79% of home buyers believe bundled services make the buying or selling process more efficient and manageable. By harnessing, bundling and digitizing broker channels, auto dealers, digital assets, merchants, insurance providers and other subservices through a single, centralized origination solution, FIs can grow their lending business and create entirely new digital experiences for end customers.

By harnessing, bundling and digitizing broker channels, auto dealers, digital assets, merchants, insurance providers and other subservices through a single, centralized origination solution, FIs can grow their lending business and create entirely new digital experiences for end customers.

Building the foundation: what’s next?

Doxim will be focused on building technology to create new digital experiences while also transforming FIs into aggregators through a data fabric that sets the foundation for an Open Banking future. In addition to buoying the broker channel, Doxim will focus on servicing FIs with tools to work with- Auto Lending channels

- Digital-first subservicing

- Merchants, to onboard onto FI-associated BNPL platform

- Digital Assets

How Doxim helps banks and credit unions expand their mortgage portfolios with third-party integrations.

The Doxim enterprise origination solution and self-service tools act as a central hub for streamlined document management, document extraction and management, income and asset verification, employment verification, title verification, appraisal management, e-closings, automated compliance, and decisioning through technology create chances, creating gains in rapid fulfillment.

Doxim Digital Origination is a powerful, integrated solution designed to meet all your origination needs through the whole customer journey. It offers a host of features designed to help banks and credit unions expand their lending portfolios, including:

The Doxim enterprise origination solution and self-service tools act as a central hub for streamlined document management, document extraction and management, income and asset verification, employment verification, title verification, appraisal management, e-closings, automated compliance, and decisioning through technology create chances, creating gains in rapid fulfillment.

Doxim Digital Origination is a powerful, integrated solution designed to meet all your origination needs through the whole customer journey. It offers a host of features designed to help banks and credit unions expand their lending portfolios, including:

- Centralized Core Lending Services Create a cost efficient and scalable base for growth, by having core lending services that are centralized and shareable.

- Standardized Processes Centrally manage all origination using consistent business rules regardless of channels/input sources.

- Origination API Smooths the integration of data from broker submission to Doxim solution, creating efficiency, speed, and transparency.

- Aggregated Lending Support Creates room for growth for bundled digital experiences.

- Shared Integrations Leverage pre-built integrations to enterprise applications including CRM, ECM, and Core Banking.

- 360 View of the Consumer Access member, household, holdings, loan information, and associated documents in one place for a true 360° view of the member.

- Channel Continuity Origination requests can continue across channels seamlessly, creating one single source of truth.

- Better Lending Decisions Readily available customer, business, and third-party data plus robust decision engine to enable better lending decisions.

- Increased Loan Processing Capacity Lower application processing time, which enables you to process a larger number of applications from the same headcount.

Doxim Digital Origination is the solution you need to expand your broker network relationships