Utility Billing Programs Have Evolved Significantly Since The Beginning Of 2020 And Some Of The Changes Are Likely To Stay

No doubt that 2020 will be a year none of us will forget soon. The uncertainty brought on by COVID-19 and the ways in which it altered everyone’s daily lives, profoundly changed how we think about even the most mundane of tasks and especially how businesses perform their operations.

Today, as vaccines are rolled out and the world continues its march back towards normalcy, some of those changes are likely to stick around permanently. Possibly because new methods were shown to be effective when there weren’t alternatives (such as working remotely) or because technology-enabled new opportunities that hadn’t been explored previously (like conducting virtual energy audits).

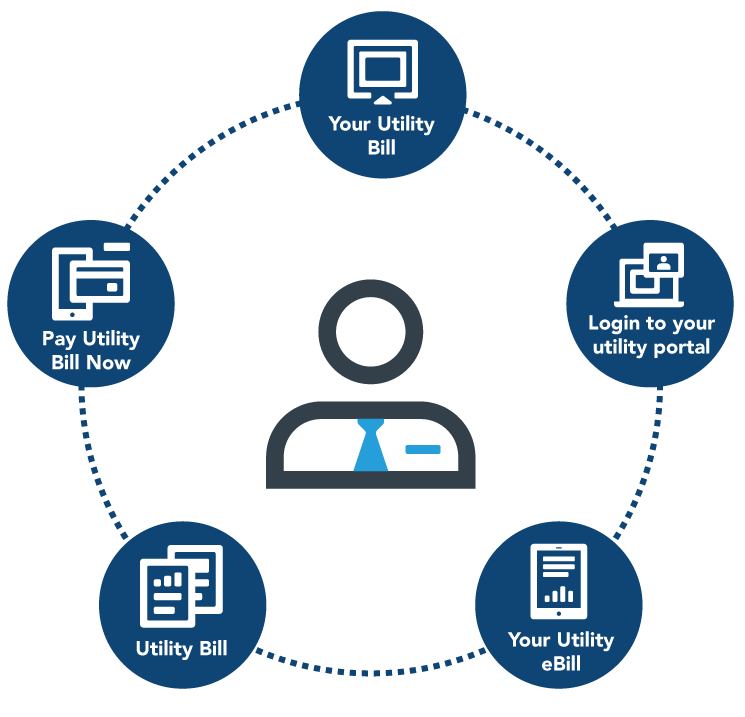

When it comes to the bill payment journey for utility customers, it may not necessarily sound like something that COVID-19 would have impacted. According to industry insiders, though, the reality is that utility billing programs have undergone significant evolution since the beginning of 2020, some of which seem likely to stay.

What Changed About Utility Billing during the pandemic?

Like so many other aspects of daily life, the landscape of utility bill payments changed for millions of customers during the peak times of the COVID-19 pandemic. The most significant, immediate change required was eliminating walk-in payments. This was to enable the safety of both customers and employees during periods of quarantining and social distancing. This shift meant that these previously in-person payments had to migrate to digital methods.

While many utility customers had already shifted to paying digitally, a notable contingent of customers had still been holding out on the shift toward paperless billing and digital payments. This group includes customers who are less technologically inclined, those who prefer paying by cash or check, those concerned with the security of digital platforms, or just the habitual payers who have never felt it necessary to change. Despite this, many utilities found themselves lucky to at least have these systems set up and available when in-person payments were no longer feasible.

Another major change to utility billing came because of the economic fallout due to COVID-19. With so many people stuck at home, needing to attend school or work virtually, electricity availability became critical, even as bills became harder to pay. As such, many jurisdictions mandated payment and collection suspensions and banned service cutoffs to those who couldn’t pay (15% of customers couldn’t fully pay their utility bills last summer, among other types of bills that were skipped out of necessity).

These provisions protected over half of customers, and they were necessary for the safety and wellbeing of customers going through extremely tough times. Now, the payment grace periods at utilities are largely ending and customers will be expected to pay once again.

The Enduring Impact on Utility Bills Today

For utilities that suspended in-person payments, the swift switch to digital was imperative. Luckily many utilities had such channels set up well in advance. However, this was not the case for all utilities and others had more ‘bare bones’ digital operations that weren’t optimized initially. These utilities had to adapt quickly, and while this was a source of stress and tension, their digital platforms are now more ubiquitous and remain available today. Along with the push for the previously non-digital payers to start using these new or improved systems, utilities found that a great degree of educational focus was critical. Early adopters of digital payments are typically customers fluent in digital technologies and payments in other industries. Those holding out however are more likely a portion of the customer base that has anxiety with such systems. So, utilities had to make sure customer service representatives were able to hold their hands, when necessary while generating online resources that could be accessed 24/7 on their websites to walk users through the process step-by-step.

These resources and new training methods were time-sensitive and thus imperative to get up as fast as possible, but are now evergreen resources utilities can utilize moving forward.

Finally, customers who had been a part of initial payment pauses and shutoff moratoriums were largely put into new or modified payment arrangement programs. Just because shutoffs were suspended doesn’t mean these customers don’t ever have to pay for those bills, but expecting them to backpay them all at once can be just as devastating as the initial COVID-19 economic impacts.

These utilities had to come up with ways to add payment plans that would stretch over long periods of time, allowing customers to make good on their balance over time, while still ensuring sufficient cash flow for them. The relative success of such programs will be a long-standing legacy of the COVID-19 period, as future disasters and events could put customers in similar positions.

The future of utility payments post-COVID-19

The quick upgrades and implementations of digital payment technologies, along with associated communications and portals, has forced all utilities to embrace synchronized and agile communications.

For effective digital payments, all portals and platforms must be in synch and customers must get consistent messaging, especially as they newly dive into the digital world of bill payment. The scale with which customers adopted digital in this period of the unknown won’t change soon, now that they’re up to date on using email, utility apps, and/or web portals. As such, this becomes a new era for utilities to keep the momentum on digital opportunities going.

Indeed, research has found that usage and adoption of digital payment methods increased dramatically in 2020, and much of that shift is expected to remain permanent across all sectors. The previous in-person payers have long been sought after by utilities, as digital payments are more reliable, affordable, and advantageous across the board.

Finally, the past year has shown the truth behind the idea that necessity is what will drive change, with 60% of customers having tried a new payment method in the past 12 months, and 86% saying their general payment habits have been changed by the pandemic.

Contactless payment became a sanitary and safety issue, but the truth is it’s more convenient and cost-effective for the utility and customer alike. Keeping payments in the digital sphere and eliminating the need for ready-to-act employees in costly facilities will be a boon moving forward.

Utilities, of course, do need to recognize the continued needs of a minority of customers, though. The World Bank finds that 1.7 billion people globally are unbanked and there are large pockets of people-particularly in rural areas-where internet access simply cannot be assumed. So, going 100% digital with payments is still likely out of reach, but every new customer switching to digital saves the utility money.

Lastly, one of the biggest silver linings of this whole situation was the way in which communities came together, and the utility company serving an area is often seen as a direct pillar of the community in which it operates. Some utilities incorporated donation platforms with payment channels to allow customers who weren’t impacted by such events to help their neighbors falling behind on payments.

This community togetherness is one of the most tangible ways we can be there for each other, and utility digital platforms can enable this in a way that supports those in trouble permanently, without hitting them with stressful backpay bills later. Helping customers to have a clean plate ensures less stress on local safety nets and continued investment in the economy of an entire region, and the digital utility tools are a key part of that now.