A CX Enhancement Approach Is The Way To Build Customer Loyalty And A Significant ROI

Today’s consumers expect the kind of customer experience (CX) they get from digital innovators and large tech platforms like Amazon and Apple. Meaning innovation in other sectors is driving service expectations to a level higher than many insurers can meet.

When embarking on a customer experience enhancement project, insurers are known to place too much focus on efficiency outcomes, like automation and cost reduction, and not enough on optimizing the customer experience.

The problem is exacerbated when decisions are made by solution architects and IT, rather than specialists who understand customer experience in insurance and how it drives customer engagement and loyalty.

The result is a cost reduction exercise that is packaged as a CX project. So, it’s highly likely that the outcome will not be an enhanced CX.

The solution: move away from ‘cost savings’ and focus on enhancing customer experience in insurance

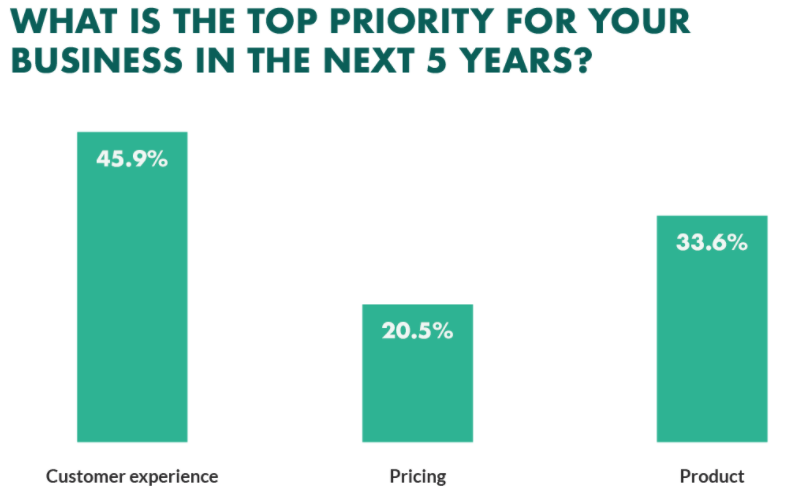

To stand out in today’s digital-first world, insurers need to differentiate themselves by making investments in CX. This should be their number one priority, as CX is now the key competitive differentiator – over product and price.

Source: SuperOffice

It is possible to achieve both an enhanced customer experience in insurance AND a reduction in costs.

How to begin improving CX in insurance

A good place to begin is to review and align the digital communication strategy. If customer communication helps enhance CX – this will become a key differentiator.

The good news is that CX enhancements can provide a significant ROI.

Consider that 86% of buyers are happy to pay for a better customer experience and a good CX results in a higher customer lifetime value.

Here are some strategies to consider:

1.Digitize the customer communication experience by offering customers the option to receive bills, policies and other communication by email or online.

But don’t negate the value of print – some customers still want their documents in hard copy. The ultimate goal is to create a seamless omnichannel experience across all communication channels including print and digital.

What does omnichannel communications mean?

Omnichannel communications is about enabling a consistent customer communication experience and content across all engagement channels, both digital (email, web, text, mobile app) and physical (branch, service center, mail). A successful omnichannel communications strategy means customers receive consistent messaging regardless of the communication channel they prefer and can seamlessly switch between channels without fracturing the experience.

2. Track customer behavior to improve the relevance of customer communication and create personalized communications which drive customer engagement, loyalty and ultimately, customer experience.

3. Insert custom offers into transactional messaging. Customers appreciate relevant marketing information that is personalized according to their interests and life stage.

The return on investment in a CX enhancement approach will be loyal customers who won’t be tempted to switch to another carrier.

We can help you enhance customer experience in insurance with seamless, omnichannel communications. TALK TO A CCM EXPERT